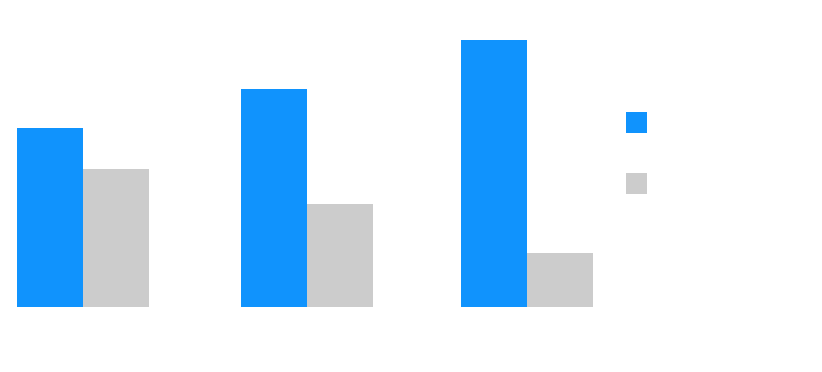

Introducing the TVision Signal - Our Weekly Look at CTV Content & Viewer Trends

Get the Report

Welcome to the TVison Signal

Each week, we’ll rank the top 20 CTV shows according to the TVision Power Score—a groundbreaking new metric that factors in both CTV viewership and engagement data across ALL CTV apps. Explore all of our latest TVision Signal reports.